Non-Linear: Random Order

Course Description

This advanced course is designed for students who possess a comprehensive understanding of accounting and taxation principles. It aims to explore a range of topics relating to accounting and taxation, including budgeting, forecasting, income tax calculation, tax management and payroll. By undertaking this advanced level of learning, students will acquire crucial knowledge about accounting budgets.

The course will provide a comprehensive overview of payroll accounting, encompassing the calculation and recording of payroll taxes and withholding. Students will also gain insights into various types of business taxes and develop skills in tax return preparation. Furthermore, the course will delve into auditing principles, covering internal audit procedures and the necessary preparations for external audits. Students will learn techniques for identifying and rectifying errors in financial records, as well as ensuring compliance with tax regulations.

Objectives

• The course aims to provide students with a comprehensive understanding of financial statements such as income statements, balance sheets and cash flow statements.

• Students should be able to analyze and interpret these statements to make informed decisions.

• The course aims to familiarize students with tax laws and regulations including federal, state and local tax laws.

• Students should be able to understand tax codes, exemptions, deductions and credits and apply them to real-life business scenarios.

• The course aims to provide students with an understanding of basic bookkeeping and accounting principles.

• Students should be able to maintain financial records including transactions, ledgers and journals.

• The course aims to teach students how to prepare budgets and forecasts for a business.

• Students should be able to analyze financial data and create financial plans to achieve business goals.

• The course aims to provide students with knowledge of auditing and internal control procedures.

• Students should be able to identify potential fraud and internal control weaknesses and design controls to mitigate these risks.

• The course aims to familiarize students with accounting software used in businesses today.

• Students should be able to navigate and use accounting software to manage financial data and create reports.

Who Should Take This Course?

• Business owners and entrepreneurs who owns a business or planning to start one. This course will help you manage your finances better and make informed decisions.

• Accounting and finance professionals who are working in the accounting or finance industry, this course will provide you with the knowledge and skills needed to excel in your role.

• Students who are studying business, accounting or finance taking this course will supplement your learning and provide you with a solid foundation in accounting and taxation.

. 1.1 Definition and Explanation of Budgeting and Forecasting

1.1 Definition and Explanation of Budgeting and Forecasting

1.2 Budgeting and Forecasting Techniques

1.2 Budgeting and Forecasting Techniques

1.3 Forecasting & Budgeting Process

1.3 Forecasting & Budgeting Process

1.4 Preparing a Budget and Forecast

1.4 Preparing a Budget and Forecast

1.5 Budgeting and Forecasting Tools

1.5 Budgeting and Forecasting Tools

BUDGETING AND FORECASTING - Assessment

5 Questions

BUDGETING AND FORECASTING - Assessment

5 Questions

2.1 Definition of Taxation Law

2.1 Definition of Taxation Law

2.2 Taxation Laws and Regulations

2.2 Taxation Laws and Regulations

2.3 Local Taxation Laws and Regulations

2.3 Local Taxation Laws and Regulations

2.4 Taxation Agencies and Authorities

2.4 Taxation Agencies and Authorities

2.5 Taxation Process

2.5 Taxation Process

2.6 Tax Act

2.6 Tax Act

TAXATION LAWS AND REGULATIONS - Assessment

5 Questions

TAXATION LAWS AND REGULATIONS - Assessment

5 Questions

3.1 Importance of Income Tax Calculation and Filing

3.1 Importance of Income Tax Calculation and Filing

3.2 Taxable Income

3.2 Taxable Income

3.3 Tax Rates

3.3 Tax Rates

3.4 Tax Credits

3.4 Tax Credits

3.5 Forms and Schedules

3.5 Forms and Schedules

3.6 Electronic Filing

3.6 Electronic Filing

3.7 Tax Preparation Software

3.7 Tax Preparation Software

3.8 Consequences of Not Filing

3.8 Consequences of Not Filing

INCOME TAX CALCULATION AND FILING - Assessment

5 Questions

INCOME TAX CALCULATION AND FILING - Assessment

5 Questions

4.1 Explanation of Goods and Services Tax (GST)

4.1 Explanation of Goods and Services Tax (GST)

4.2 Benefits of GST

4.2 Benefits of GST

4.3 GST Structure

4.3 GST Structure

4.4 GST Registration

4.4 GST Registration

4.5 GST Returns

4.5 GST Returns

4.6 Input Tax Credit (ITC)

4.6 Input Tax Credit (ITC)

4.7 GST Compliance

4.7 GST Compliance

4.8 GST Audit

4.8 GST Audit

4.9 GST for Small Businesses & E-commerce

4.9 GST for Small Businesses & E-commerce

GOODS AND SERVICES TAX (GST) - Assessment

5 Questions

GOODS AND SERVICES TAX (GST) - Assessment

5 Questions

5.1 Introduction to Tax Planning and Management

5.1 Introduction to Tax Planning and Management

5.2 Types of Tax planning

5.2 Types of Tax planning

5.3 Tax Planning Strategies

5.3 Tax Planning Strategies

5.4 Tax Management Techniques

5.4 Tax Management Techniques

5.5 Taxation and Business

5.5 Taxation and Business

5.6 Taxation and Individuals

5.6 Taxation and Individuals

TAX PLANNING AND MANAGEMENT - Assessment

5 Questions

TAX PLANNING AND MANAGEMENT - Assessment

5 Questions

6.1 Introduction to Payroll

6.1 Introduction to Payroll

6.2 Payroll Processes and Stages

6.2 Payroll Processes and Stages

6.3 Employee Compensation and Benefits

6.3 Employee Compensation and Benefits

6.4 Payroll Compliance

6.4 Payroll Compliance

6.5 Payroll Reporting and Analysis

6.5 Payroll Reporting and Analysis

6.6 Payroll Best Practices

6.6 Payroll Best Practices

6.7 Recap of Key Concepts and Topics in Business Accounting and Taxation

6.7 Recap of Key Concepts and Topics in Business Accounting and Taxation

6.8 Future Developments and Trends in Accounting and Taxation

6.8 Future Developments and Trends in Accounting and Taxation

PAYROLL - Assessment

5 Questions

PAYROLL - Assessment

5 Questions

Final Assessment

20 Questions

Final Assessment

20 Questions

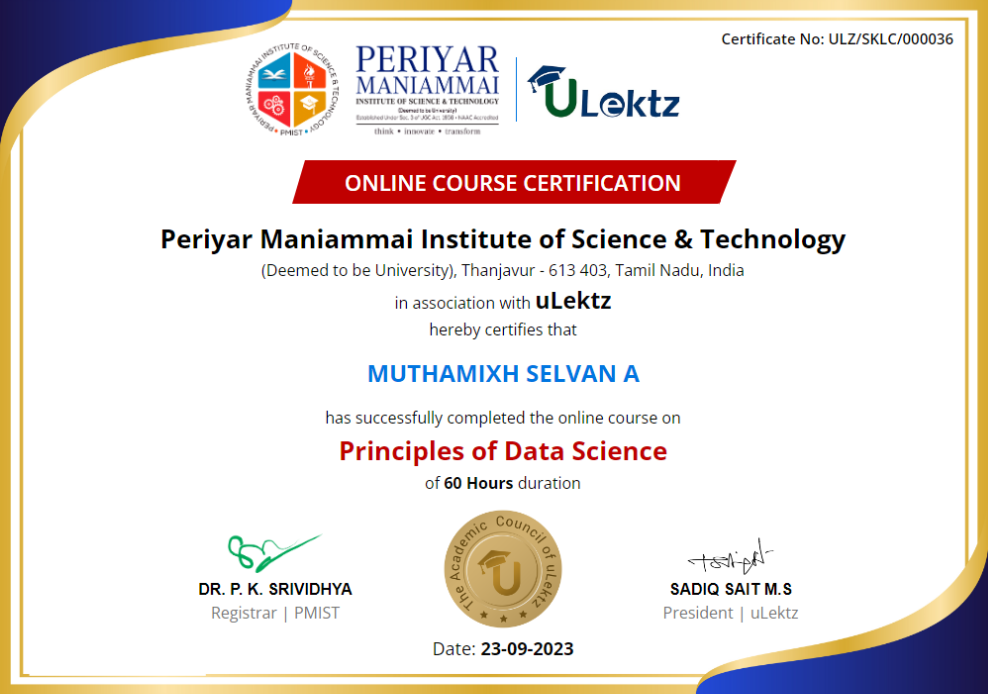

The certificate issued for the Course will have the student's Name, Photograph, Course Title, Certificate number, Date of course completion and the name(s) and logo(s) of the Certifying Bodies. Only the e-certificate will be made available. No Hard copies. The certificates issued by uLektz Learning Solutions Pvt. Ltd. can be e-verifiable at www.ulektzskills.com/verify.

60 hours Learning Content

60 hours Learning Content 100% online Courses

100% online Courses English Language

English Language Certifications

Certifications